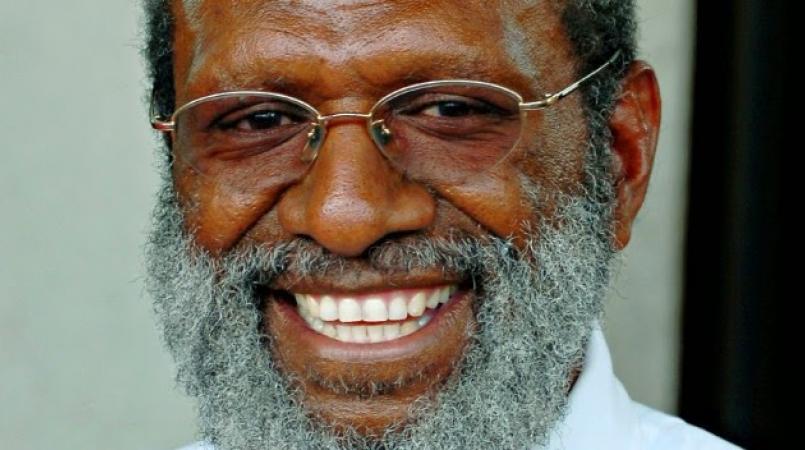

Sinasina Yonggumgl MP Kerenga Kua is calling on elected leaders to start taking responsibility and stop PNG’s slide into further impending debt this year.

He said Papua New Guineans will soon pick up the pieces of this colossal financial disaster come March 13, 2016 when the UBS (Union Bank of Switzerland) collar loan facility matures and falls due.

Kua in a statement said the government would need to repay this debt by settling the A$900 million (K1.8 billion) to UBS or refinance the current existing facility with an additional and more expensive short-term debt facility.

“My concern arises also from the fact that the Prime Minister unashamedly announced recently at a Port Moresby breakfast meeting that he would move to refinance the existing liability without explaining that an additional but more expensive short term debt facility is also urgently required.

“The UBS Debt Facility of A$1.2 billion (K2.45billion) that Prime Minister Peter O’Neill unilaterally initiated in March 2014 to acquire 149 million shares in the Oil Search is undoubtedly Papua New Guinea’s most speculative and high risk investment to be funded essentially from our petroleum proceeds.

“I am of the view that neither the O’Neill Government nor Kumul Petroleum Limited (KPL) has the financial capacity today to settle this enormous debt obligation because of the ongoing cash flow crisis exacerbated by this government’s poor performance in economic management.”

Kua stressed that as a result of not meeting this debt obligation, Papua New Guinea for the very first time would go into default on a commercial loan causing disastrous consequences involving the country’s ability to borrow and engage credibly with investment partners (and traditional donors) to fund future robust policy agendas and real development outcomes.

“Even more worrying is the possibility that our national petroleum company that holds the nation and its people’s interest in the PNG LNG could possibly fail an insolvency test.

“Importantly owing to the fact that this Collar Loan as a debt facility has been novated to Kumul Petroleum Limited (KPL) by the O’Neill Government, puts extraordinary pressure on its cash position.

“Already last year the government forced Kumul Petroleum to pay ‘dividends’ to the tune of K45O million to Consolidated Revenue Fund as an unbudgeted windfall to support its desperate attempt to bridge the looming fiscal gaps.

“NEC has inordinately added more pressure by demanding a further K300 million from Kumul Petroleum by November 20 1 5, an undertaking that KPL has not met because of its cash flow troubles,” he said.

He said if this were combined with the principle amount in the bridge facility, it would amount to A$390 million (K797.87m) for a short-term debt facility of six months with an extension period of an additional six months.

Loop PNG contacted the Prime Minister for his comments but did not get a favourable response.