As we welcome in the New Year, families will be asked to pay lots more for basic food and commodities because of new taxes imposed by the Government.

Shadow Minister for Treasury and Finance, Ian Ling-Stuckey, says over 70 new tax increases have been imposed from 1 January 2019.

“This includes a 15 percent tax increase for wheat flour used for making basic items such as bread – lifting the tariff level to a massive one-quarter of imported costs. You can get around this tariff increase, but only if you buy a bag of flour that weighs over 50 kilograms. This is economic lunacy!

“There is not even a wheat industry in PNG so the government cannot use its usual protectionist, anti-APEC arguments. How can the government justify such an increase?” asked Ling-Stuckey.

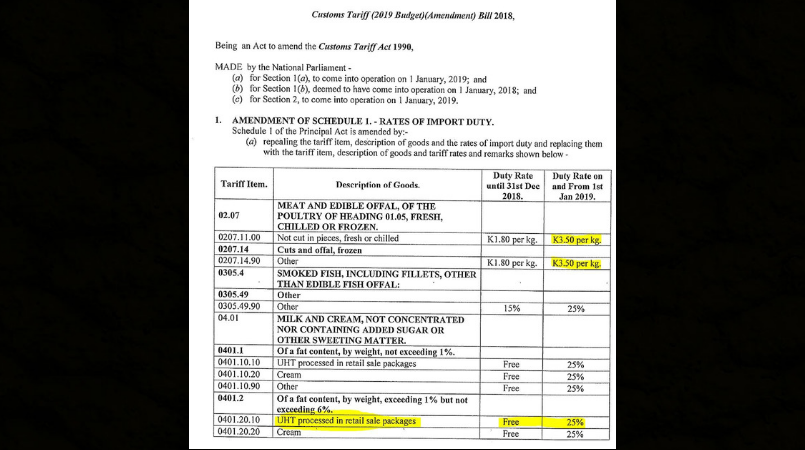

“Families in PNG are already struggling under the cost of living. So why is the government imposing an additional tariff tax of K1.70 per kilogram on all imported fresh chicken pieces? This will lift the tariff tax up from K1.80 per kilogram to K3.50 per kilogram.

“Surely our chicken industry doesn’t need such a high tariff level! Surely our people should not be slugged with such price increases just to meet excess profits for government besties and cronies.

“When the government imposed a 25 percent tax on imported fresh milk last year, it claimed that the cost of milk would halve. Treasurer Charles Abel claimed on 12 January last year that he understood the tariff tax would only apply to fresh milk and not to UHT milk. So I have been waiting for the price of UHT milk to halve to K3 per litre or less! We know that has not happened.

“In the tariff tax increases from 1 January 2019, with all of the additional tariff lines applying to milk products, it has been confirmed that the new milk tax will apply to all UHT milk. The new 25 percent tariff will also apply to all creams, yogurt and ice-creams. This is a Treasurer who tells the people one year that the government’s intent was not to apply the massive new tax to UHT milk, but then he introduces a bill that does exactly that.

“We support new investment in our agriculture sector, and encourage entrepreneurs to bring back new industries such as dairy products. But this needs to be done in ways that do not involve massive government subsidies of 50 percent of equity start-up costs, or backed by massive tax tariffs which hurt the cost of living facing families,” stated the Shadow Treasurer.

“We know that there is a housing shortage in PNG and the cost of accommodation is too high. So why does the government impose a 50 percent tax tariff on timber and metal products vital for building a house? What has happened to justify an increase in tax tariffs on plywood, blockboard, laminboard and batten board from 30 blockboard to 50 blockboard.

“Our timber manufacturing industry should be becoming more efficient, which is why the tariff reduction program had legislated to cut the tariff level to 25 blockboard. Why lift the tax tariff from 25 blockboard to 50 blockboard? Do such firms now need to make excess profits to pay others like politicians?

“Surely our manufacturers can produce items such as wood furniture without a 50 blockboard tariff level that imposes excessive costs on the people of PNG!

“The O’Neill/Abel PNC government is out of touch. It does not understand the cost of living burden facing PNG families. We keep seeing policies that simply are in the interests of the government besties and cronies.

“The government’s protectionist policies such as these over 70 new tariff increases are totally contrary to the spirit of APEC and its trade liberalisation agenda. Such PNC policies destroy incentives for sustainable growth while also slugging the people of PNG. This is not a good start to 2019,” added Ling-Stuckey.