K250 is the annual tax payment amount that small and micro business owners will pay under the recently-launched Small Business Tax regime.

Introduced in 2019, the recently-launched Small Business Tax regime gives sufficient ‘breathing space’ for small and micro businesses.

Ruth James from the IRC Taxpayer Services Division in Lae said small and micro businesses initially came under the income tax regime, where there are a number of compliance requirements that are quite costly.

She said this previous classification was of no benefit to small businesses and the government as well.

“Because we’re looking at the GST threshold of K250,000 and below and when we really look at the micro and small business owners, they don’t qualify to be in the income tax regime,” James stated. “And so with the government and IRC identifying this, the small business tax regime is to cater for them.”

Micro businesses have an annual turnover below K60,000 while those who make between K60,000 and K250,000 are categorised as small businesses.

IRC has so far listed 300 sole traders in Morobe Province. With this new tax regime, James said many more could be identified and registered.

Furthermore, the province has set a target of 600 taxpayers to be registered by the end of this year, while the total target for the Northern region is 1,200.

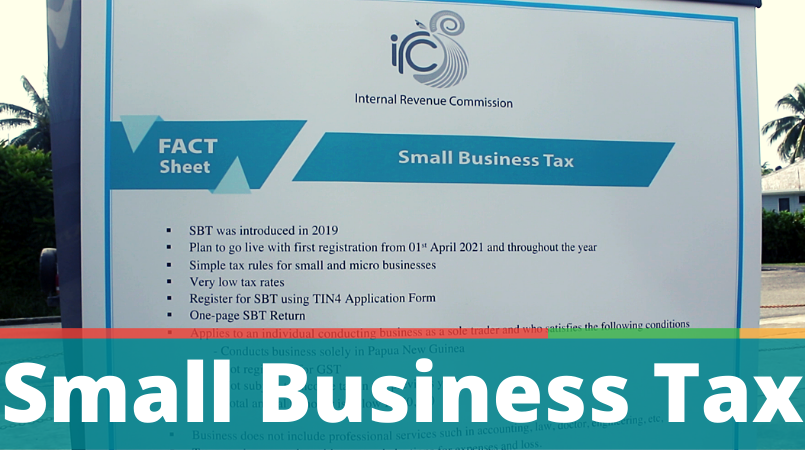

IRC SBT factsheet:

- SBT was introduced in 2019

- SBT commenced on 21st May 2021

- Simple tax rules for small and micro businesses

- Very low tax rates

- Register for SBT using TIN4 Application Form

- One-page SBT Return

- Applies to an individual conducting business as a sole trader and who satisfies the following conditions

- Conduct business solely in Papua New Guinea

- Not registered for GST

- Not subject to income tax in the previous year

- Total annual turnover is below K250,000

- Business does not include professional services such in accounting, law, doctor, engineering, etc.

- Turnover is gross sales without any deductions for expenses and loss.

- Two (2) categories of small businesses:

- Micro business

- Small business

- Micro business

- Business with annual turnover below K60,000

- File annual SBT Return once a year

- Pay flat tax of K250 flat tax once a year

- Due date for filing and payment is 28 January

- Small business

- Business with annual turnover from K60,000 to not more than K250,000

- File quarterly SBT Return four (4) times in a year

- Pay K62.50 plus 2 percent on quarterly turnover that exceeds K15,000

- Due date for filing and payment is the 28th day of the following month after end of each quarter.

- Generally, on average all SBT taxpayers would be paying K250/year except when ‘small’ make a sales turnover of more than K15,000 in a quarter. Then they pay K62.50 plus 2 percent of the amount that exceeded K15,000. If below, they pay K62.50/quarter, which adds to K250/year.

- Minimum records to maintain are record of sale and a wage register (if there are employees)

- Assumed that employees would be receiving salaries below fortnightly tax threshold of K480 or less.

- Record must be maintained for three (3) years

- Can elect to be taxed under the normal income tax regime after three years

- Those individual currently subject to income tax and who satisfy the SBT conditions can elect to be taxed under SBT regime