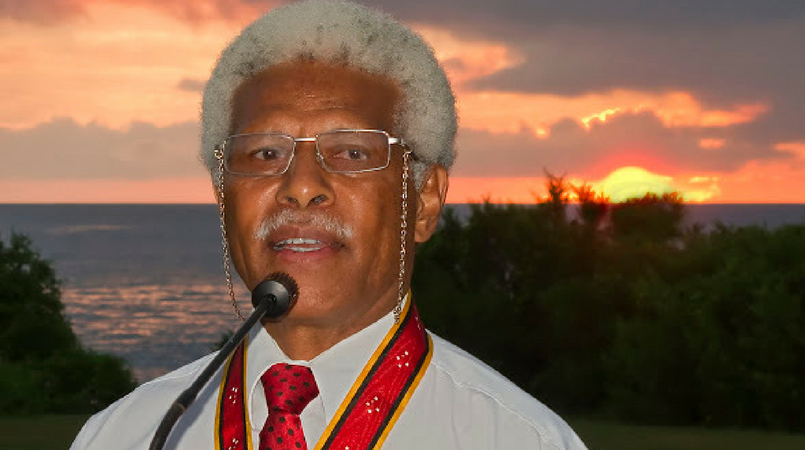

Former attorney-general and minister for justice, Sir Arnold Amet, has called on the PNG Government to terminate its partnership with Nautilus Minerals or risk losing the investment along with the company.

Sir Arnold made the comments in light of Nautilus struggling to raise sufficient funding for immediate working capital requirements and facilitate payments required to continue the development of the seafloor production system, to be used at the Solwara 1 Project.

The comments are made also in light of the resignation of Russel Debney in December 2017 as director and chairman of Nautilus. He had been on the Nautilus board since 2006.

In his statement published on the ‘Deep Sea Mining Campaign’ website, Sir Arnold said Debney, investors and financial institutions can see the uncertainty and risk surrounding the project.

He said the company admitted the project was experimental with unknown environmental and social consequences with uncertain profits and the past few months have shown the extent to which financiers and PNG communities reject the project.

“This high risk project is a foolhardy investment when our country has so many pressing needs. In order to acquire our 15 percent equity, the National Government obtained a loan in 2014 from the Bank South Pacific of almost PNG K400 million,” stated Sir Arnold.

“It’s also likely that the Government has provided Nautilus with generous incentives, which would further limit the potential to raise revenue from this project.

“This is irresponsible in the context of our country’s ever increasing debt bill. There is little likelihood of a positive return from this project to the balance sheet of the economy.

“The recent bridging loans for the project are a drop in the ocean – only 1/50th of the total funds required.”

Nautilus recently arranged bridge loans to the tune of K21 million (US$7 million), which is expected to form part of a larger secured structured credit facility of up to US$34 million (K104 million) to be provided by the lender, Deep Sea Mining Limited.

“These bridging loans are from existing board directors through a new private investment company incorporated in the British Virgin Islands. Such financial structures are commonly known as ways for minimising tax. And because the loan is from a related party, there was no need to even consult the PNG Government as the minority equity holder. If we stay in this deal, it will be the people of PNG who will have to pay,” claims the former statesman.

“The best course of action now is for the PNG Government to terminate its joint venture agreement with Nautilus before our investment ends up sinking to the bottom of the ocean along with the company. In addition, Nautilus’ licences are renewed every 2 years.

“The environmental uncertainties surrounding this project call for the Government to decline renewal. Indeed, given the poor financial record of the company, the government should consider suing Nautilus for the recovery of the full K400 million investment as its 15 percent equity stake is now virtually worthless.”

On Tuesday Nautilus announced the appointment of Tariq Al Barwani to the role of non-executive chairman.

The company’s board of directors are also embarking upon a process of board renewal, looking to appoint additional new independent directors to expand the board’s skill sets to support the financing and delivery of the world’s first deep sea mine.