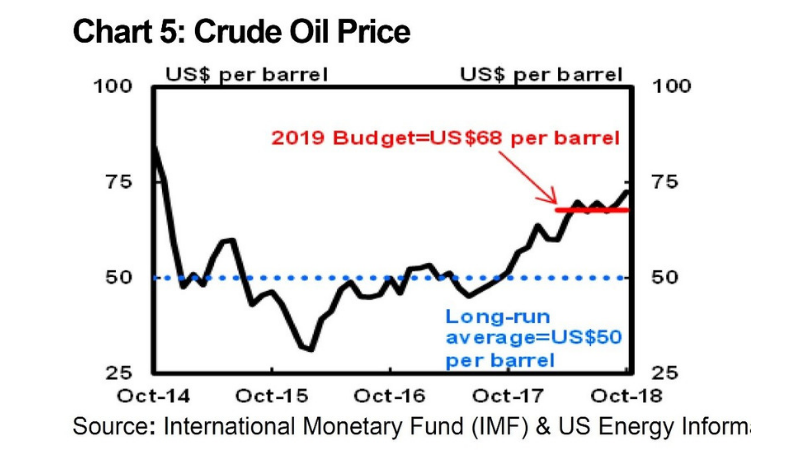

The fall in oil prices from $US85 per barrel at the time of the 2019 budget preparations down to $US52 per barrel just two months later demonstrates the risks of the government relying too much on resource revenues.

In a statement, Shadow Minister for Treasury and Finance, Ian Ling-Stuckey, said: “Based on the latest IMF oil price projections and using the figures in the 2019 Budget, PNG is facing a 2019 revenue shortfall of at least K638 million.

“The government should have kept to its new budget deficit anchor which would have delinked vital government expenditure from the ups and downs of oil prices. Instead, the government went on a spending spree based on the high oil prices of mid-2018 which have since collapsed. This was irresponsible budgeting and the PNG people are now facing once again the pain of O’Neill/Abel’s economic mismanagement.

“As I outlined in the 2019 Budget Reply Speech, this government went on a reckless spending spree when it spent all of its K1 billion in 2018 and expected 2019 K1.3 billion resource revenue bonus from high oil prices. This broke the promises in the Budget Strategy, and the promises made to the World Bank and international investors, that PNG would save such revenue windfalls. This dangerous decision is coming home to roost as oil prices have fallen sharply since October 2018.

“The O’Neill/Abel government assumed oil prices would average $US68 per barrel in 2019. However, the IMF, in its January World Economic Outlook Update, dropped expected oil prices down by $US8 to $US60 per barrel. So what does such an oil price drop mean for PNG?

“Using the government’s own budget figures, a fall of $US3 per barrel in oil prices between 2019 and 2020 (from $US68 to $US65 per barrel) was expected to reduce resource revenues by K638 million – from K1,856.2 million in 2019 to K1,218.6 million in 2020. However, the fall in oil prices has occurred one year earlier, and the fall has been more than twice as severe. So the likely fall in resource revenue is at least K638 million in 2019 – and could be much more,” stated the Shadow Treasurer.

“The oil price bonus of last year should have been invested into the Sovereign Wealth Fund to help stabilise expenditures. But there is no operational Sovereign Wealth Fund. It continues to be a myth, in the same way as the often promised but never delivered “Independent Commission Against Corruption” remains a myth.

“Just as we know that any O’Neill government will never take action to stop corruption, we also know this government will never take action to properly fix the economy. It is time we had a new coalition that will get jobs and incomes growing again, understands the cost of living burden on families, and will better manage the budget to deliver essential services,” said Ling-Stuckey.

(The IMF in its January 2019 World Economic Outlook update lowered the price forecast for oil in 2019 down to $US60 per barrel, and for this price to continue into 2020 - https://www.imf.org/en/Publications/WEO/Issues/2019/01/11/weo-update-january-2019)