The Kina Petroleum Limited board has raised $A5.4m (K12.7 million) following the placement of 75 million fully paid ordinary shares to investors at a subscription price of 7.178c per share.

The Kina board said in a statement the strategic and sophisticated investors include Phil Mulacek who, together with his affiliated company PIE Holdings LP, will maintain the percentage holding established in November 2014.

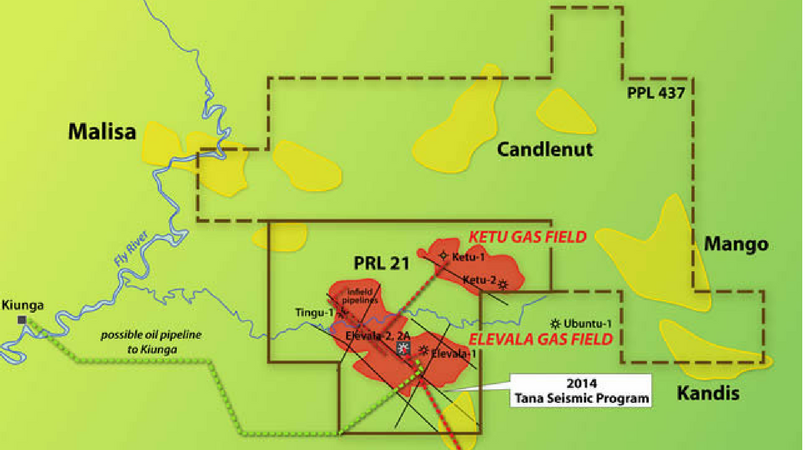

Funds raised from this placement will be applied to Kina’s ongoing working capital requirements, particularly in relation to its two key retention licences Petroleum Retention Lease (PRL) 21 (Elevala-1 and Ketu-1) and 38 (Pandora offshore discovery), where pre-development work is ongoing.

The funds will also allow the company to capitalise on selected exploration opportunities, including potential near term activities in respect of its Petroleum Prospecting Licence 338 (Gulf Province) and PPL 339 licences (Gulf, Morobe, Eastern Highlands and Simbu provinces) in the Forelands.

The placement provides Kina with certainty of funding through the next phases of licence activity and in advance of developing the hydrocarbon discoveries in PRLs 21 and 38.

Managing Director and CEO, Richard Schroder, said the fund strengthens the company to commit to ongoing work.

“Funds provided by this placement will ensure the company’s continued financial strength through the near term and provide us with the confidence and ability to commit to a range of activities that will further our understanding of both our pre-development and exploration acreage.

“The fact that Phil Mulacek has seen fit to increase his cornerstone investment together with PIE Holdings is a tremendous vote of confidence in the work that the company is undertaking and the significant inherent value yet to be unlocked in both Western Province and the Forelands.

“That the placement has been able to be executed without transaction costs only adds to the value provided,” Schroder said.

The placement shares will be issued pursuant to the 15 percent placement capacity that exists pursuant to ASX Listing Rule 7.1 (covering 46,111,800 Placement Shares) and the 10 percent placement capacity that exists pursuant to Listing Rule 7.1A (covering 28,888,200 Placement Shares).

Kina says the placement will result in the following dilution to existing holders of ordinary securities:

· On completion of the placement of securities under Listing Rule 7.1, the number of fully paid ordinary shares on issue before completion of the placement of securities under Listing Rule 7.1A will be 353,864,588;

· The number of fully paid ordinary shares on issue following completion of the placement of securities under Listing Rule 7.1A will be 382,752,788; and

· The percentage of voting dilution due to the portion of placement shares that are to be issued under Listing Rules 7.1A will be 7.55 percent, with the total dilution due to the Placement being 19.59 percent.