Kina Petroleum Limited (KPL) remains committed to early commercialisation of the 48 million barrel liquids resource in Petroleum Retention License (PRL) 21 in Western Province.

The Company states in its 2018 fourth quarter report that it is reviewing funding strategies for early development work.

KPL says it continues to advocate the feasibility of production form the early 2020’s, a timeframe which would be of significant benefit to all stakeholders.

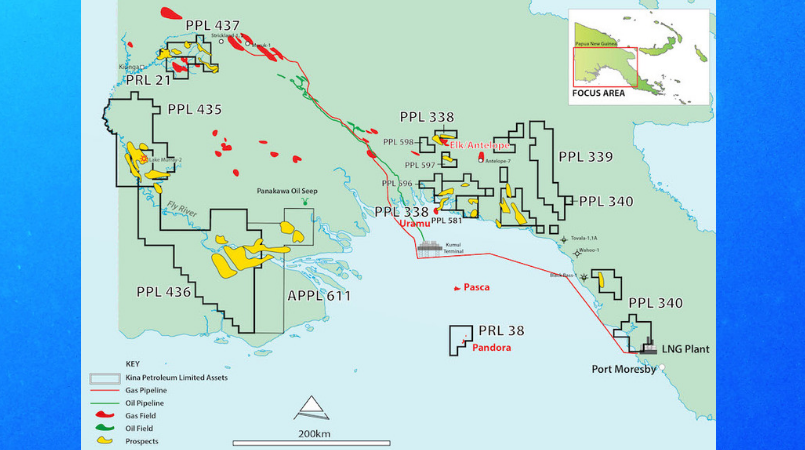

“PRL 21, together with prospects in PPL 437, provide a natural focus for a future liquids hub in Western Province using the Fly River as a virtual export pipeline.

“Their proximity to the Port of Kiunga make them the obvious candidates for early development ahead of the smaller discoveries in our licenses to the south east.

“To the South of Kiunga where the Fly River changes direction to the south east, a second tier of large prospects have been identified and high-graded by Kina.

“The trend from Aiambak to Alligator and Barramundi in the South East are the mirror image of the Stanley/Elevala to Manta/Douglas/Puk Puk trend.

“Large structures east of the Puk Puk-1 Well tested by the Koko-1, Komewu-1 and Goari-1 Wells along the Komewu Fault (Northeast Fly platform) failed due to the loss of the critical leru shale seal.

“The differentiating factor for the Aiambak to Alligator/Barramundi Prospects that makes them more attractive for potential development is the preservation of leru shale seal at these locations. These prospects are very large and represent material value additive potential in the event of drilling success.

“Kina’s work in development concepts demonstrates that the 2C (liquids) contingent gas resource of 48 million barrels of condensate in PRL 21 is economic at current oil prices.

“Kina maintains its belief that a future development of the Elevala & Ketu fields should aim for liquids production in the early 2020’s and believes this can be achieved by the joint venture. To further our commitment to an early liquids development, Kina is evaluating potential funding options.”

The company says prices have settled back to US$60 per barrel since the last report and the economics of development of Kina’s key prospects, and PRL 21 in particular, remain robust at these prices.

KPL has, at the end of his period, a participating interest in Petroleum Retention License (PRL) 21 and in ten exploration licenses (PPLs) across PNG. Kina is in discussion with the PNG Government about how best to capture the Aiambak and Alligator Prospects, and any extensions of the Alligator prospect.